-

Nieuws Feed

- ECOSYSTEM

- EXPLORE

-

Pagina

-

Groepen

-

Events

-

Blogs

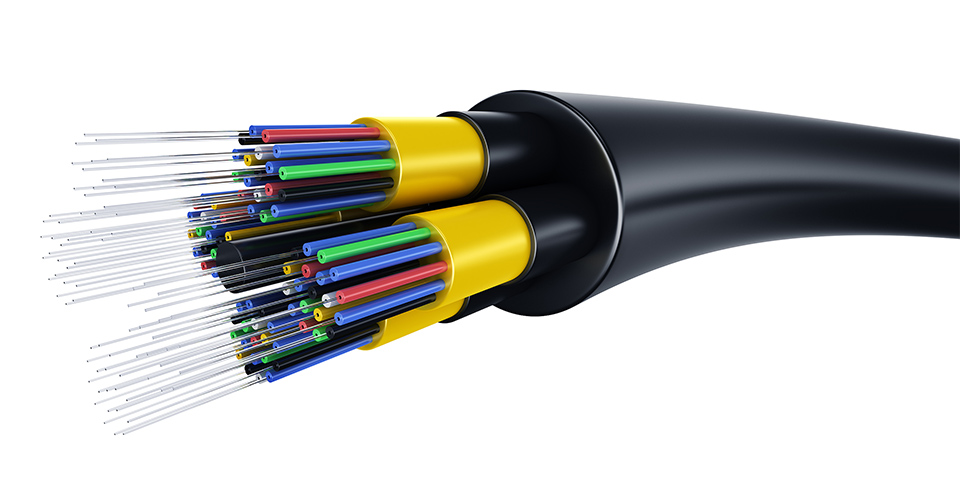

Analyzing the Evolving Dynamics of Global Fiber Optic Cable Market Share

In the capital-intensive and technologically complex world of telecommunications infrastructure, the battle for Fiber Optic Cable Market Share is a contest fought by a small number of massive global industrial giants. The market is highly consolidated, with the top five manufacturers accounting for a very large portion of the global market share. These companies, based in the US, Europe, and Asia, have achieved their dominant position through decades of investment in research and development, by building up a massive and highly efficient global manufacturing scale, and by securing a strong portfolio of patents around their core fiber and cable manufacturing processes. Market share in this industry is not easily won; it is the result of long-term strategic investment and a proven track record of producing high-quality, reliable products at a massive scale.

This highly consolidated competitive landscape is operating within an industry that is growing at a strong and steady pace, which further solidifies the position of the incumbent leaders. The overall market is on a firm trajectory to expand to a size of USD 30.5 billion by 2030, propelled by a healthy compound annual growth rate (CAGR) of 13.50%. This sustained growth provides a massive and predictable stream of demand that the large, established players are best positioned to meet. The massive capital investment required to build a new, world-scale optical fiber manufacturing plant is a huge barrier to entry for new competitors, which means that the current market share distribution is likely to remain relatively stable, with the leaders competing amongst themselves for large global contracts.

The primary strategies for capturing and maintaining market share are varied. The key strategy for all the leaders is to achieve a superior manufacturing cost position through massive scale and continuous process improvement. Another critical strategy is to have a broad portfolio of different fiber and cable types to meet the diverse needs of different network applications, from undersea to the data center. A strong and long-standing relationship with the world's major telecommunications companies, who are the primary customers, is also a critical part of the strategy. A major strategic battleground is in the development of new, next-generation fiber technologies that can offer higher performance or a lower total cost of ownership, which can be a powerful way to gain a competitive advantage and to win share.

Looking forward, the future distribution of market share could be influenced by geopolitical factors. The increasing focus on national security and the desire for technological self-sufficiency in some countries could lead to a greater emphasis on supporting domestic or regional manufacturers. However, the global nature of the supply chain and the massive scale of the incumbent players make this a difficult market to disrupt. The companies that can continue to invest in R&D, that can maintain their manufacturing excellence, and that can provide the most cost-effective and highest-performance solutions to the world's network builders will be the ones who will continue to hold the largest share of this critical and valuable market.

Explore Our Latest Trending Reports:

Europe Automation Testing Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness