-

Ροή Δημοσιεύσεων

- ECOSYSTEM

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Ομάδες

-

Events

-

Blogs

Secure Access Services Edge Market Outlook, Revenue, and Demand | 2032

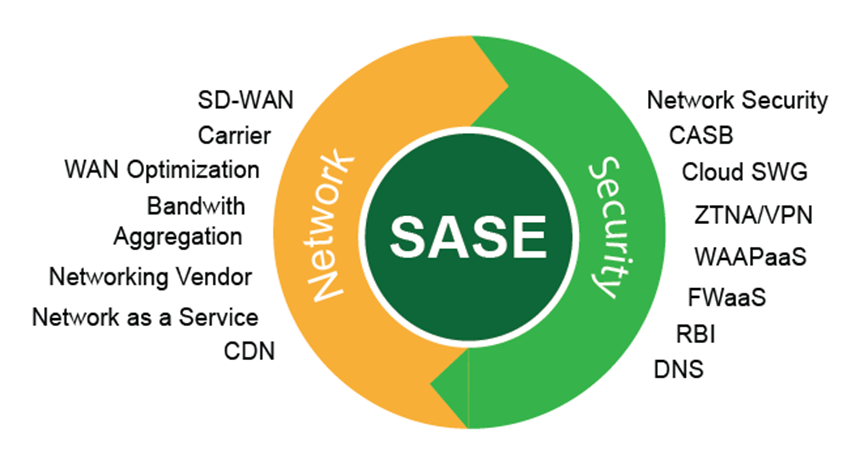

A detailed analysis of the global SASE market reveals a powerful and accelerating trend towards Secure Access Services Edge Market Share Consolidation, with a significant wave of merger and acquisition (M&A) activity that is fundamentally reshaping the competitive landscape. This trend is driven by a powerful and inescapable strategic logic: SASE, by its very definition, is a converged platform that combines a wide range of networking and security capabilities. The Secure Access Services Edge Market size is projected to grow USD 42.86 Billion by 2032, exhibiting a CAGR of 22.1% during the forecast period 2024-2032. The primary driver of this consolidation is the strategic need for vendors to build a complete, end-to-end SASE portfolio. The market was initially populated by a host of specialized, "point solution" vendors that were strong in one specific area of the SASE framework, such as SD-WAN, Secure Web Gateway, or Zero Trust Network Access. The major players are now aggressively using M&A to acquire these best-of-breed point solutions and to stitch them together to create a single, comprehensive SASE platform. This allows them to offer a more integrated, "one-stop-shop" solution to their customers and to capture a larger share of the overall enterprise network and security budget.

The consolidation trend is playing out in a number of different ways, reflecting the different starting points of the major competitors. The large, established networking giants are a major force of consolidation, and they have been actively acquiring innovative cybersecurity startups to build out the security side of their SASE offering. For example, a leading SD-WAN provider might acquire a Cloud Access Security Broker (CASB) or a Zero Trust Network Access (ZTNA) company to integrate those capabilities directly into their networking platform. On the other side of the coin, the large, established cybersecurity leaders are also a major driver of consolidation, and they have been acquiring networking companies to build out the networking side of their SASE platform. For example, a leading cloud security provider might acquire an SD-WAN company to be able to offer a fully converged networking and security solution. This M&A-driven convergence from both sides of the traditional network/security divide is the defining feature of the market's consolidation trend.

While the primary trend is one of consolidation by the major platform players, the market is also seeing a high level of investment and M&A activity from private equity (PE) firms. The SASE market, with its high growth rates and its attractive, recurring-revenue SaaS business model, is a very hot sector for PE investment. Private equity firms are playing a significant role in the market's consolidation, both by acquiring and combining smaller, complementary vendors to create a larger and more competitive new platform, and by providing the capital for the established SASE players to make their own strategic acquisitions. This influx of PE money is further accelerating the pace of M&A and is putting pressure on all the players in the market to either achieve scale or be acquired themselves. The long-term trend is clearly towards a market with a smaller number of large, comprehensive platform providers who have assembled a full suite of SASE capabilities through a combination of in-house development and strategic acquisitions.

Top Trending Reports -

Device as a Service Market Size, Trends | Global Report - 2035

Integration Platform as a Service Market Size, Trends - 2035

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness