-

Noticias Feed

- ECOSYSTEM

- EXPLORE

-

Páginas

-

Grupos

-

Eventos

-

Blogs

India 2-Wheeler Market Size, Trends, Demands, Growth, Forecast & Report 2032 | UnivDatos

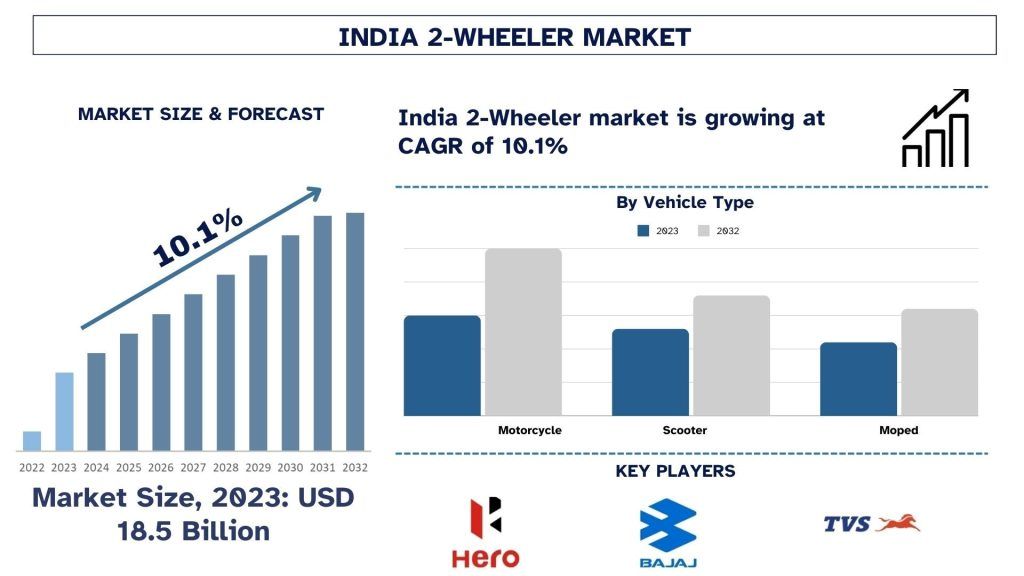

The India 2-Wheeler Market was valued at approximately USD 18.5 Billion in 2023 and is expected to grow at a robust CAGR of around 10.1% during the forecast period (2024-2032)

India currently stands as the second-largest two-wheeler market globally, following China and Japan in terms of production and sales. The market continues to benefit from strong economic growth, rising disposable incomes, and increasing urbanization. These factors have accelerated discretionary spending and boosted demand for affordable personal mobility solutions.

Key Market Drivers and Opportunities

Two-wheelers remain a preferred mode of transportation in India due to rising fuel prices, affordability, and limitations in public transport infrastructure. Scooters and motorcycles have shown consistent growth as they offer convenience, fuel efficiency, and cost-effective commuting.

Manufacturers play a key role in driving demand by offering a wide range of models tailored to diverse consumer needs. Product innovation, competitive pricing, and expanded financing options have enhanced customer satisfaction and improved overall quality of life. Additionally, growing youth employment and lifestyle changes continue to support long-term market growth.

Impact of COVID-19 on the Market

The COVID-19 pandemic significantly disrupted the Indian two-wheeler market. According to data from the Ministry of Transport, sales in the first quarter declined to 3.66 million units, representing a 24.6% year-on-year drop. Sales fell by 15.9% in January and 19.8% in February, followed by sharper declines in March and April due to the nationwide lockdown.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-2w-market?popup=report-enquiry

ICRA estimates total two-wheeler sales for the fiscal year at approximately 18 million units, reflecting an 11–13% decline compared to the previous year. However, post-lockdown trends suggest that two-wheelers—particularly mass-market motorcycles and scooters—may gain traction as commuters avoid public transport due to health concerns.

Industry Overview

India has nearly 200 million vehicles on its roads, with two-wheelers accounting for about 70% of the total. The industry holds vast domestic potential driven by population growth, urban expansion, and evolving mobility needs. The key product segments include scooters, motorcycles, and mopeds.

Between 2012 and 2018, over 124 million new two-wheelers were sold in India, with annual sales increasing by nearly 8 million units, highlighting strong demand despite infrastructure challenges.

ICE vehicles dominated the market in 2019 and are expected to maintain the largest share through 2025. However, electric two-wheelers are projected to grow rapidly due to benefits such as low emissions, reduced operating costs, home charging convenience, minimal noise, and lower maintenance requirements.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-2w-market

By ICE Vehicle Type

- Motorcycle

- Scooter

- Moped

- Performance Bike

- Others

Motorcycles held the dominant share in 2019, driven largely by young, working consumers who favor motorcycles for daily commuting and affordability.

By ICE Vehicle Class

- Economy

- Executive

- Premium

- Others

The economy segment accounted for the largest market share and is expected to remain dominant during the forecast period. Meanwhile, the premium segment is anticipated to grow steadily, supported by new launches, technological upgrades, and rising consumer purchasing power.

Competitive Landscape

The Indian two-wheeler market is highly consolidated, with three major players controlling over 80% of total market share. Key manufacturers include:

Hero MotoCorp, Honda, TVS, Bajaj, Royal Enfield, Yamaha, Suzuki, Piaggio, Mahindra, Kawasaki, Harley-Davidson, and Triumph.

The competitive analysis covers mergers and acquisitions, product launches, capacity expansions, partnerships, and financial performance, offering valuable insights for stakeholders and investors.

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

Linked In: https://www.linkedin.com/company/univ-datos/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness