India Buy Now Pay Later Market Size, Share, Trends, Segments & Forecast 2033 | UnivDatos

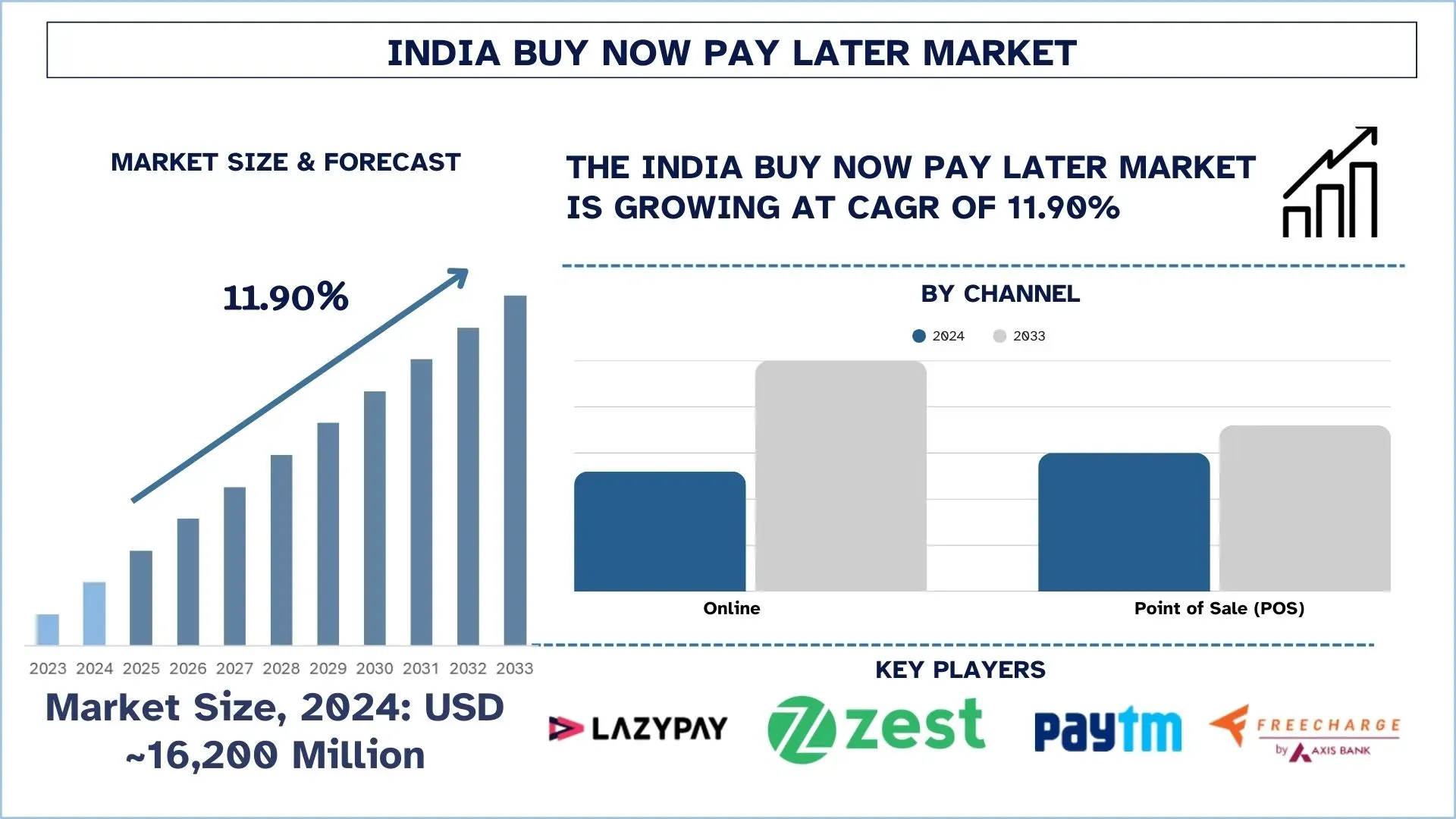

The India Buy Now Pay Later Market was valued at USD ~16,200 million in 2024 and is expected to grow to a strong CAGR of around 11.90% during the forecast period (2025-2033F)

Digital Ecosystem Integration: BNPL’s penetration is also increasing because of Unified Payments Interface (UPI), wallets, and smartphones, which allow instant credit facilities at the point of purchase.

Shift to zero-cost EMI: BNPL is now popular compared to credit cards for easy and financial methods, and consumers prefer zero-interest and no-fee EMI.

Evolving Usage Across the Different Segments: The primary client base that is driving the company’s growth is from its usage across online interface, large clients, and zones, including North and South India, and expansion across Tier II & III cities.

Current Developments: To grow sustainably, BNPL players are now targeting the expansion of the merchant base, AI-based credit assessment, and sound credit origination.

According to a new report by UnivDatos the India Buy Now Pay Later market is expected to reach USD XX million in 2033 by growing at a CAGR of 11.9% during the forecast period (2025-2033F). The primary factors include an increase in the use of digital payments, a relatively low credit card market in India, and an increasing demand for affordable & flexible financing. Adding to this, internet usage through smartphones and the growth of e-commerce business in non-metro regions increase the number of users. The markets also get the backing of the regulators in the digital lending industry, which also boosts confidence.

For instance, on October 6, 2022, Pine Labs announced that it had entered the wearables segment in the consumer electronics category. Shoppers in India can now purchase wearable devices of select brands on a Buy Now Pay Later arrangement using Pine Labs’ PoS terminals. Top brands offering their wearable products under the Pine Labs Pay Later EMI option include Fire-Boltt and PLAY.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-buy-now-pay-later-market?popup=report-enquiry

Driver: Increasing Digital Payment Adoption via UPI & Wallets

Factors like UPI and digital wallets have grown quite fast in India, and this has laid the right platform for BNPL. Consumer, on the other hand, have increased using UPI for their daily payments and transactions since more than 10 billion transactions are done every month until early 2025. This is particularly in line with BNPL, which is in harmony with digital checkouts and makes processes easier and faster. This is so because more and more users are familiar with other payment applications such as PhonePe, Paytm, and Google Pay, which increases the acceptance of BNPL.

Thus, UPI and wallets also give BNPL useful information about the financial transactions of a user, which can be used to determine credit score, especially for those who have no credit score. This means that in the same way, a completely delinked underwriting paradigm underpins the prospects of low-risk onboarding of new-to-credit customers from Tier II and III towns and cities. That includes increasingly faster, convenient, and more trusted digital payment methods that fuel the growth of BNPL in e-commerce, retailing, and service industries. Consequently, BNPL will experience a high growth rate as more individuals participate in digital payments.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-buy-now-pay-later-market

According to the report, the impact of Buy Now Pay Later has been identified to be high for the West India area. Some of how this impact has been felt include:

West India is expected to grow with a significant CAGR during the forecast period (2025-2033). Cities like Mumbai and Pune in West India are in the lead when it comes to the adoption level of BNPLs; as such, this region is highly developed in terms of fintech adoption. The general populace has a high credit literacy, and Africa’s increased adoption of e-commerce also serves as a conducive environment for BNPL. The region seems to have an excellent and established infrastructure that lends itself well to both online and offline BNPL. Currently, BNPL players are popular among startups and enterprises in Maharashtra and Gujarat. The increasing success rate of e-commerce is due to the constantly rising demand from young people and working professionals in the region.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Channel, By Enterprise Size, By End-User Industry, and By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness